by I. Slav, Jul 03, 2022 in OilPrice

There is a glaring problem in the energy transition that not many people are acknowledging.

It is being built on the back of finite resources, and the mining industry is already warning that there aren’t enough metals for all the batteries the transition will require.

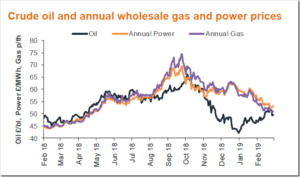

Because of the short supply, prices are on the rise, as are prices across commodity sectors.

The energy transition has been set by politicians as the only way forward for human civilization. Not every country on the planet is on board with it, but those that are have the loudest voices. And even amid the fossil fuel crunch that is beginning to cripple economies, the transition remains a goal. It is no secret that the transition—at the scale its architects and most fervent proponents envisage it—would require massive amounts of metals and minerals. What does not get talked about so much is that most of these metals and minerals are already in short supply. And this is only the start of the transition problems.

Mining industry executives have been warning that there is not enough copper, lithium, cobalt, or nickel for all the EV batteries that the transition would require. And they have not been the only ones, either. Even so, the European Union just this month went ahead and effectively banned the sales of cars with internal combustion engines from 2035.

“Rare earth materials are fundamental building blocks and their applications are very wide across modern life,” a senior VP at MP Minerals, a rare-earth miner, told Fortune this month. He added that “one third of the demand in 2035 is not projected to be satisfied based on investments that are happening now.”

Because of the short supply, prices are on the rise, as are prices across commodity sectors. According to a calculation by Barron’s, the price of a basket of EV battery metals that the service tracks has jumped by 50 percent over the past year as a result of various factors, including Western sanctions against Russia, which is a major supplier of such metals to Europe.

…