by V. Jayaraj, Feb20, 2026 in ClimateChangeDispatch

In 2022, Alex Epstein released “Fossil Future,” his treatise on why humanity requires more coal, oil, and natural gas to flourish. When the book appeared, the Biden administration was making extravagant pledges to fund global climate initiatives. [some emphasis, links added]

Executives of major financial institutions and energy firms were making theatrical commitments to reducing their use and production of fossil fuels.

But four years later, those same industry titans are scrambling for excuses to delay or abandon net-zero goals and seeking to develop the energy sources they had publicly disavowed.

Business leaders cite supply chain complexities, technological barriers, and cost overruns. Some even acknowledge that fossil fuels are a necessity of modern life.

However, for national governments, reversing course is complicated by entanglements in the bureaucratic web of international climate agreements.

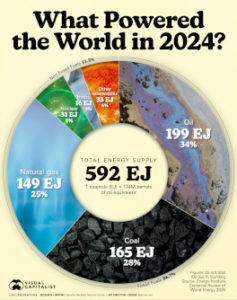

Hence, they maintain the language of action – as though they could control something as huge and complex as the climate system, while systematically securing long-term supplies of fossil fuels and expanding hydrocarbon infrastructure.

No country displays this pragmatism better than India, which has quietly delayed its net-zero commitments to a distant 2070.

Behind a green veneer, India doubles down on every form of useful hydrocarbon available.

In doing so, it has emerged as a key export market for U.S. liquified natural gas (LNG) and a bellwether for global energy reality.

Coal Reality Quashes Green Illusion

…