by RailwayGazette, January 4, 2019

That’s about 10 years worth of current US coal production, which will come out of the Xinjiang region at a rate of 150 millions per year for 43 years. US utilities are doing what?

…

by RailwayGazette, January 4, 2019

That’s about 10 years worth of current US coal production, which will come out of the Xinjiang region at a rate of 150 millions per year for 43 years. US utilities are doing what?

…

by P. Homewood, March 30, 2019 in NotaLotofPeopleKnowThat

…

Anybody expecting that retirements will start outstripping new builds soon will be severely disappointed however.

As we know, the UK has already shut many coal plants, and the ones left are generating very little power. Other EU nations are following suit, so there will soon be little scope for further retirements.

Meanwhile Germany and several eastern European countries, such as Poland have no intention of moving away from coal for many years to come.

In the US, coal power generation has fallen by 39% in the last decade, principally due to low gas prices. It now only accounts for 13% of global coal generation.

Worldwide, there is 574 GW of coal power in the pipeline, including 281 GW outside of China and India. Whatever the US and EU do will scarcely make a dent in that lot.

by M. Xu & D. Patton, March 26, 2019 in Reuters

BEIJING (Reuters) – China added 194 million tonnes of coal mining capacity in 2018, data from the energy bureau showed on Tuesday, despite vows to eliminate excess capacity in the sector and to reduce fossil fuel consumption.

Total coal mining capacity in the country was at 3.53 billion tonnes per year by the end of 2018, according to a statement from the National Energy Administration (NEA). That compares to 3.34 billion tonnes at the end of 2017.

…

by EIA, March 27, 2019

While U.S. coal consumption has generally declined since its 2008 peak, EIA expects that U.S. coal exports reached 116 million short tons (MMst) in 2018, the highest level in five years, based on foreign trade data collected by the U.S. Census Bureau. Exports of coal from the United States have increased since 2016 as international prices have made it more economic for U.S. producers to sell coal overseas.

In 2018, the United States exported 15% of its coal, and the remaining 85% was sold to end-use markets, primarily power sector and industrial customers. Coal exports have increased during the past two years, driven by increasing international coal demand, and in 2018 accounted for the largest share of total U.S. coal disposition on record. The United States exported 54 MMst of steam coal and 62 MMst of metallurgical coal in 2018, based on export data collected by the U.S. Census Bureau.

…

GlobalData, March 6, 2019 in GreenCarCongress

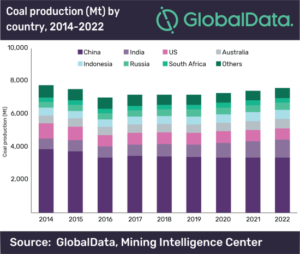

Although Germany, the UK, US, Canada and Ukraine are phasing out domestic coal production capacity, expansion of production capacity in countries such as India and Indonesia is predicted to generate modest annual growth of 1.3% in coal production over the next four years, with output reaching 7.6 billion tonnes in 2022, according to GlobalData, a leading data and analytics company.

…

by P. Homewood, March 1, 2019 in NotaLotofPeopleKnowThat

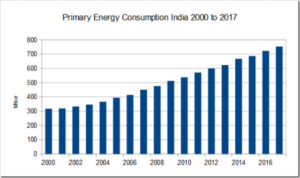

India is the world’s second most populous country and figures among the world’s most rapidly growing economies, reports the World Coal Association.

The South Asian giant is home to one-fifth of the world’s population and an additional 315 million people – almost the population of the United States today – are expected to live in India’s cities by 2040.

Since 2010, the country’s GDP has grown at an annual average of 6.8% and it is projected to surpass Germany at some stage in the 2020s to become the fourth largest in the world, and Japan sometime around 2040 to become the third.

…

by Anthony Watts, January 27, 2019 in WUWT

From the LA times, a bold move, but unlikely they can pull it off.

Germany to close all 84 of its coal-fired power plants, will rely primarily on renewable energy

…

…

The decision to quit coal follows an earlier bold energy policy move by the German government, which decided to shut down all of its nuclear power plants by 2022 in the wake of Japan’s Fukushima disaster in 2011.

…

The initial targets are considerable, calling for a quarter of the country’s coal-burning plants with a capacity of 12.5 gigawatts to be shut down by 2022. That means about 24 plants will be shut within the first three years. By 2030, Germany should have about eight coal-burning plants remaining, producing 17 gigawatts of electricity, the commission said.

…

by M. Meng & D. Patton, January 21, 2019 in Reuters

BEIJING (Reuters) – China’s December coal output climbed 2.1 percent from the year before, government data showed, hitting the highest level in over three years as major miners ramped up production amid robust winter demand and after the country started up new mines.

…

by John Parnell, January 10, 2019 in Forbes

China has said it will not approve wind and solar power projects unless they can compete with coal power prices.

Beijing pulled the plug on support for large solar projects, which had been receiving a per kWh payment, in late May. That news came immediately after the country’s largest solar industry event and caught everyone by surprise.

Officials are understood to have been frustrated at seeing Chinese suppliers and engineering firms building solar projects overseas that delivered electricity at prices far below what was available back home.

…

by Connaissance des Energies, 18 décembre 2018

Trois jours après la clôture de la COP24, l’Agence internationale de l’énergie (AIE) a publié le 18 décembre son rapport annuel consacré au charbon. Elle y souligne le rôle central de cette énergie au niveau mondial et estime que sa consommation globale devrait rester stable dans les 5 prochaines années. Explications.

La consommation de charbon encore appelée à augmenter en Inde et en Asie du Sud-Est

Après deux années de baisse, la consommation mondiale de charbon a augmenté de près de 1% en 2017 et cette hausse devrait se poursuivre en 2018 selon les dernières estimations de l’AIE. Principalement consommé à des fins de production électrique(1), le charbon a encore compté pour 38% de la production mondiale d’électricité en 2017.

Dans son rapport Coal 2018, l’AIE estime que la consommation mondiale de charbon pourrait rester stable d’ici à 2023 : la baisse de la demande envisagée en Europe et en Amérique du Nord serait plus que compensée par une forte croissance de la consommation en Inde et en Asie du Sud-Est selon les prévisions de l’Agence.

…

by Stephanie Roker, November 22, 2018 in WorldCoal

Indonesia’s consumption of domestic coal for power generation will almost double from 84 million t in 2018 to 157 million t by 2027. This increases power generation’s share of domestic consumption from 18.5% to 33.6%, which is likely to displace export tonnage.

Another factor contributing to the higher coal consumption is that Indonesia’s new power plants are designed to consume lower energy coal. This means more coal will be required per unit of electricity generated.

This increase in domestic consumption combined with potential government efforts to conserve coal reserves represents a downside risk for Indonesian exports.

Indonesia’s electrification programme to drive domestic coal demand

…

by P. Homewood, November 17, 2018 in NotalotofPeopleKnowThat

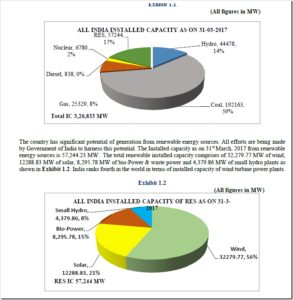

It’s worth taking a closer look at the claim made last week that India is leading the world in tackling climate change.

The claim was based on India’s latest National Electricity Plan (NEP), which was published in April 2018. Below is the current situation for installed capacity, according to the NEP:

…

by CarbonBrief, June 5, 2018

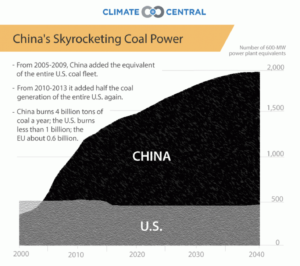

Since 2000, the world has doubled its coal-fired power capacity to 2,000 gigawatts (GW) after explosive growth in China and India. Another 200GW is being built and 450GW is planned.

More recently, 200GW has closed due to a wave of retirements across the EU and US. Another 170GW is set to retire by 2030 and 13 of the world’s 77 coal-powered countries plan a total phaseout.

Meanwhile, electricity generated from coal peaked in 2014, so the expanding fleet is running fewer hours than ever. This erodes coal’s bottom line, as does competition from gas and renewables.

The way coal’s next chapter unfolds is key to tackling climate change. All unabated coal must close within a few decades if warming is to be limited to less than 2C above pre-industrial temperatures, according to the International Energy Agency (IEA).

To shed light on this story, Carbon Brief has mapped the past, present and future of all the world’s coal-fired power stations. The interactive timeline map, above, shows the plants operating in each year between 2000 and 2017, as well as the location of planned new capacity.

Using data from CoalSwarm’s Global Coal Plant Tracker, it features around 10,000 retired, operating and planned coal units, totalling nearly 3,000 gigawatts (GW) across 95 countries.

by Jude Clemente, November 15, 2018 in Forbes

Even with the Paris climate accords signed in late-2015, global coal demand in 2017 rose for the first time in two years, as reported by the Paris-based International Energy Agency during its annual World Energy Outlook release week.

…

Global coal use increased in 2017, despite claims it is “dying.”DATA SOURCE: BP; JTC

by P. Homewood, October 31, 2018 in NotaLotofPeopleKnowThat

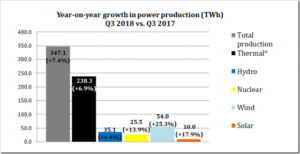

China’s power statistics have now been published for Q3, and continue to show thermal generation rising quickly. (Thermal includes coal, gas and biomass).

The rise in thermal generation since last year is more than from all other sources put together.

Biomass is virtually irrelevant in the overall view of things, having only accounted for 1.2% of generation last year.

Once again, we see that China’s unstoppable demand for energy cannot be supplied from wind and solar alone. Indeed. these two sources have only contributed 18% of the extra year-on-year demand.

In overall terms, wind and solar have only supplied 4.6% and 1.3% respectively of China’s generation so far this year.

…

by J. Hopkins, September 28, 2018 in ClimateChageDispatch

Foreign markets are lining up to purchase American coal by widening amounts as U.S. coal consumption reaches its lowest level in more than three decades.

Power plants’ consumption of coal dropped to 298 million short tons in the first half of 2018, a sharp fall from 312 million in the same period last year, according to a Thomson Reuters report.

This marks the lowest level of consumption since 1983 and a reflection of the coal industry’s declining status as natural gas continues to grow.

Coal-fired generation diminished by 32 billion kilowatt-hours during the first six months of 2018.

…

by Matt McGraph, September 27, 2018 in BBCNews

Building work has restarted at hundreds of Chinese coal-fired power stations, according to an analysis of satellite imagery.

The research, carried out by green campaigners CoalSwarm, suggests that 259 gigawatts of new capacity are under development in China.

The authors say this is the same capacity to produce electricity as the entire US coal fleet.

…

See also here

by David Middleton, September 18, 2018 in WUWT

Even though coal’s lead has been cut from 17 to 2 States since 2007, it’s still in first place. Numbers in parentheses reflect the change since 2007.

Coal: 18 (-10)

Natural Gas: 16 (+5)

Nuclear: 9 (+3)

Hydroelectric: 6 (+2)

Petroleum: 1 (0)

Total: 50

What about wind and solar? Let’s ask Dean Wormer!

…

by P. Homewood, September 2, 2108 in NotaLofPeopleKnowThat

Something so extraordinary has lately been going on at the other end of the world that, if it did not run so flatly contrary to the prevailing groupthink of our time, it would surely have made big headlines over here.

We may have gathered that there has been something of an earthquake in the politics of Australia, where the prime minister Malcolm Turnbull faced such a revolt by his Cabinet colleagues over “climate change” that he was eventually forced out of office, to be replaced as leader by Scott Morrison.

But the real significance of this has only now come to light with the unveiling by Australia’s new energy minister, Angus Taylor, of the country’s wholly new energy policy, which completely reverses that of the Turnbull government.

…

by JoNova, July 2, 2018

Coal is a dying industry, but luckily for the Australian economy, the rest of the world is not as smart as The Australian Greens and Labor Party and they are still buying it.

Coal is set to regain its spot as the nation’s biggest export earner amid higher prices and surging demand from Asia, sparking fresh calls from the Turnbull government for Labor to end its “war on coal”.

The Department of Industry, Innovation and Science figures show total coal exports are forecast to reach $58.1 billion in 2018-19, overtaking iron ore ($57.7bn) for the first time in almost a decade. (…)

by Prof. F. Vahrenholt, June 12, 2018 in NoTricksZone

Only Europe and Canada exiting coal

Another reason the Paris Accord is collapsing is because it’s not going to do anything we were promised it would.

When it comes to coal, Vahrenholt notes, so far only Europe and Canada have expressed some sort of a commitment to exit coal, and then he reminds us China, India and all developing countries will still be permitted to continue “massively” expanding their use of coal. He writes : (…)

by Anthony Watts, June 17, 2018 in WUWT

A couple of days ago, we noted that this year’s edition of BP’s annual Statistical Review of World Energy report on global energy use is out, and it contains one of the most telling charts about the failure of the climate crusade’s “war on coal” ever presented.

Most of the lamestream media coverage has focused on this particular chart from the BP report, which shows coal having a small uptick in 2017 after several years of decline. Doesn’t look like much, does it? Just a blip. Nothing for the enviro-faithful to worry about, the net trend is still down, right?

(…)

by Dave Keating, May 31, 2018 in PowerUp

Germany’s task force for phasing out coal was meant to launch this week, but yesterday the government quietly announced it is delaying the kick-off. It is the third time the coal exit commission’s launch has been delayed.

The task force has become so controversial – even before it comes into existence – that the government can’t get it started. Since the idea was proposed by German Chancellor Angela Merkel last year, it has been plagued by fighting over who will lead it, what it will do, and how much power it will have.

by Andy May, May 17, 2018 in WUWT

U.S. coal production declined from 2011 through 2016 as it was displaced in U.S. power plants by cheaper and cleaner natural gas. Some of the reduction was also due to the Obama Clean Power Plan regulations. However, the shale gas revolution in the U.S. has not spread to other countries, perhaps due to the “fracking” scare, so worldwide use of coal increased rapidly until 2013. From 2000 until 2013 global coal use increased at a rate of over 4% per year. This led to an increase in U.S. coal exports (see Figure 1) because the U.S. is a low-cost producer of high quality coal. Coal consumption worldwide has flattened and is expected to stay flat through 2040, according to ExxonMobil’s 2018 Energy Outlook as well as the EIA. Currently coal provides 25% of the global energy supply and this is projected to decrease to 20% by 2040 according to ExxonMobil.

Figure 2. U.S. coal export terminal construction locations blocked by environmentalist lobbying. Source: The Wall Street Journal.

by Paul Homewood, May 15, 2018 in NotaLotofPeopleKnowThat

From the US EIA:

Egypt, Oman, Iran, Jordan, and the United Arab Emirates (UAE) have no current coal-fired electricity generation, but they each plan to build coal capacity in the near future. New coal capacity is currently under construction in the UAE, Iran, and Jordan. In addition, Egypt and Oman have announced plans for new coal-fired generators.

In the UAE, new coal-fired capacity will come from Dubai’s Hassyan Project. The project consists of 3.6 GW of ultra-supercritical generating capacity, 2.4 GW of which is currently under construction and expected to become operational between 2020 and 2022. Another 1.2 GW was announced for a total of 6 units (with an average size of 600 megawatts (MW) expected to come online in 2023. The $3.4 billion project is sponsored by several investors, including Chinese and domestic banks.