by D. Middleton, Oct 4, 2022 in WUWT

SEPTEMBER 30, 2022

Advances in technology led to record new well productivity in the Permian Basin in 2021The Permian Basin in western Texas and eastern New Mexico is one of the world’s most prolific unconventional oil- and natural gas-producing regions. The Permian Basin has become more productive because of the technological advancements in drilling and completion techniques, which allow operators to economically extract hydrocarbons from the low permeability reservoirs.

The stacked reservoirs of the Permian Basin, and the Delaware and Midland subbasins within it, vary in thickness and depth. Improved geological understanding, known as subsurface delineation, helps operators place wells to optimize well spacing in the most productive areas.

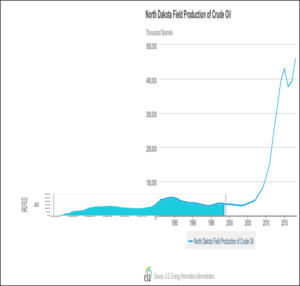

The Permian Basin has produced oil and associated natural gas from vertical wells for decades. Since 2010, advances in hydraulic fracturing and horizontal drilling led to rapid production growth. The number of new horizontal wells increased to 4,524 in 2021, compared with 350 in 2010. In June 2022, the Permian Basin accounted for about 43% of U.S. crude oil production and 17% of U.S. natural gas production (measured as gross withdrawals).

The length of a well’s horizontal section, or lateral, is a key factor in well productivity. In the Permian Basin, average well horizontal length has increased to more than 10,000 feet in the first nine months of 2022, compared with less than 4,000 feet in 2010.

…

…

See also:

Malthus, Ehrlich and now… Peak Permian

- Peak Oil Postponed Again: “USGS Identifies Largest Continuous Oil and Gas Resource Potential Ever”… And it’s in the Permian Basin

- Another Ignorant Forecast of the Death of the Shale Boom

- Another Permian Basin Peak Oil Prediction… Yawn.

- This Week’s Peak Permian Prediction? Why “Peak Permian” is almost an oxymoron.

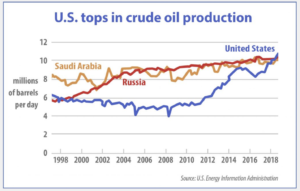

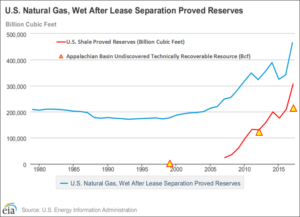

Figure 2. “The effects American ingenuity and new technology can have.”…

Figure 2. “The effects American ingenuity and new technology can have.”…